The range of services that accounting firms provide to their clients is both broad and diverse. As a matter of fact, there is a good choice of Accounting firms in Zambia including affiliates of the global accountancy groups like KPMG, PwC, Ernest and Young and Deloitte.

The following directory provides a list of Zica registered audit firms to will help you find accountancy, audit and tax experts easily.

It is a complete list of audit firms, professional accounting firms that are fully registered by Zica both non audit practice firms and audit practice firms

Souce: Zica Website

Home » All posts

Zica Registered Audit Firms

Why Cemeteries in Africa Need CIMS Software

Human death and burials are part of human life. Among many cultures in Africa, cemeteries are more than just a place of burial they carry spiritual, religious and cultural significance.

The reality is that the thousands deaths through AIDS have created a serious problem in regard to the existence and future of cemeteries in Africa and the burden of day-to-day management, long term planning and sustainability remains with local authorities.

As city centers emerge, management, maintenance, record keeping and environmental issues related to cemetery management become key issues of concern in many African countries.

With the shortage of burial space in Africa’s big cities, some local authorities in countries like Zambia, South Africa and many African counties slowly plan to professionalise the burial industry. Stories of adopting new practices and good practices like burying more than one family member in one grave are currently under consideration in many Africa countries.

However, the true challenge of cemetery management in Africa begins with cemetery mapping and information systems. Most council cemeteries were opened way before GIS cemetery digital mapping existed. Since then a few cemeteries relied on hand-drawn inaccurate cemetery plot map while in most cemeteries no cemetery database existed.

To accomplish this goal of best practices in cemetery management, a different approach to traditional cemetery records management is required – one which encompasses in new, yet simple technology that can enhance customer experience by providing families with more interactive and helpful tools to memorialize a loved one, and use the web technology to interact meaningfully with cemeteries and preserve the burial records from fires, floods and many other natural disasters. Record protection is vital to preserving the history of the cemetery whilst also ensuring the cemetery is operating efficiently. Happily, the scenario is slowly changing. There are a few success stories of cemeteries in Africa using some simple innovative cemetery software to help visitors locate grave sites.

Please take a moment to answer these questions….

- Are your grave, burial, cremation registers, books of remembrance, and plot maps deteriorating from being used everyday? Are they getting difficult to read?

- .Do members of your staff have difficulty handling the large registers?

- When members of the public ask for historic information, do you still manually search through the books in order to find records?

- Are you interested in putting your records online for the public to view

- Are you looking for a robust, low-cost and simple to use Cemetery Information Management System (CIMS) for your Cemetery or Crematorium?

How to use eNapsa to file Monthly Napsa Returns

Do you need to submit your NAPSA return? Submitting your monthly NAPSA returns online via eNAPSA is easy and convenient once you understand the steps.

The National Pensions Scheme Authority has implemented eNAPSA a new system for filling monthly NAPSA returns before making payment.

To start using eNAPSA you can follow this step by step guide below.

Step 1:

Complete the eNAPSA services registration form which can be downloaded from the NAPSA website under the menu “Pension Information > Contributions > Contributions downloads” as shown below or alternatively you can obtain a hard copy from any NAPSA office.

Step 2:

Return the completed form to a nearest NAPSA office or you can scan and email a completed form to to Customer Services via info@napsa.co.zm and wait for the SMS from NAPSA which will confirm your account update.

Step 3:

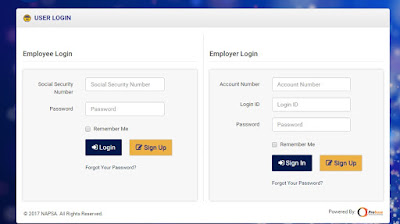

Finish the eNAPSA registration process by visiting the NAPSA website www.napsa.co.zm and click on eServices tab and go to sign-up.

Step 4:

If you are an employer, login using the employer account number, login ID and password but if you are a member, use your social security number and password sent to you by the eNAPSA system via sms.

If you face any particular challenge with signing up and uploading returns, do not panic, the Authority has set up eNAPSA help desks at all their offices countrywide.

Their eNAPSA helpdesks are open on all working days across the country feel free to call their toll free number 677.

7 Ways On How An Accountant Can Help Businesses Today

|

| Zica Graduates |

Understanding a Tax Invoice

I am compelled to write on what I term the gross misuse of source accounting documents by some small and medium Enterprises (SMEs).

It pains me to go in a business entity, make a cash purchase and the accounting source document you are given as proof of the purchase, is a document called tax invoice with a paid stamp on it.

This trend is common among businesses especially in the supply business. Sometimes I wonder if these businesses do engage well trained accountants who should be able to advise management the proper usage of accounting source documents such as a tax invoice.

Honestly speaking how can a tax invoice bear two names at the same time? On the far corner it is written a tax invoice while at the other end it bears a receipt name.

Although the Zambia Revenue Authority (ZRA) administration of value added tax (VAT) entails that its determination is based on the tax invoices especially to the supplying businesses, it has not changed the meaning of the definition of an invoice.

I say so because these problems of misuse of source documents are emanating from the misunderstanding of the use of the tax invoice as demanded by ZRA.

Let the entrepreneurs know that the description of an invoice remains the same whether it is disguised as a tax invoice by ZRA or not.

An invoice is a source accounting document that is issued by the supplier to a customer who obtains goods or services on credit and promises to settle a payment at a later date.

Therefore it is not in order for a supplier to issue an invoice to a customer who makes a prompt cash payment.

However in this article I want to trace why some suppliers are issuing tax invoices in place of a receipt because a source document which is issued for prompt payments, is a receipt.

This is so because VAT is driven by invoices and its calculation is based on the issuance and retention of tax invoices when calculating it.

Therefore the law requires the retention of tax invoices and other tax records for the period of not less than six years from the time they are issued.

The tax invoice is an invoice which is designed by the tax office to suite its requirement for the benefit of collecting VAT by the Government and is enforced through the law.

The rate of collecting VAT in Zambia is 16 percent. Registered suppliers for VAT purposes are required by law to issue tax invoices to their customers, but this mostly applies to non-retail suppliers in this country.

A tax invoice has certain requirements on its face required by the tax office. The following are the tax invoice requirements demanded by the tax office on the face of a tax invoice:

1. The word tax invoice must be on the face.However even the issuance of tax invoices by the businesses who are non-retailers is backed by the VAT law, the tax office has not replaced the receipt with the tax invoice.

2. The name and address must be on the face

3. The VAT registration number has been replaced by the tax payers identification number (TPIN) on the face.

4. The serial number of the invoice and the date of issue, a must.

5. The quantity or volume of goods or services supplied.

6. Description of the goods or services supplied.

7. The selling price excluding the VAT and any discount allowed.

8. The total amount of VAT charged.

9. The total amount of VAT inclusive.

Instead, as a matter of prudent accounting and practiced by accountants who know the implication of the invoice and a receipt in the books of accounts, will issue a tax invoice immediately followed by the receipt for the purpose of fulfilling of the VAT law.

The advice given to businesses that are issuing tax invoices to the customers who make prompt cash purchase to customers in order to fulfill the VAT law is that immediately they issue a tax invoice should issue cash purchase receipts to cancel the invoice.

9 Major Tips to Manage the Business Expenses of Your Organization through Spreadsheets

Expense Management Software – Top 10 Reasons Why Companies Need To Implement Them

Still claiming your expenses via spreadsheets, outdated legacy or in house system. Is it time to look back on the traditional ways with nostalgia, as here are the top 10 reasons why expense management needs to be automated in the right way and you don’t have to be a big organization as the benefits are hard to ignore.

Saving your money in more than 1 way: Many business organizations fear of being trapped and continuing with their current system, as the organizations these days are more worried about the cost to change. The implementation of these pricing models are based on the usage could be done quickly and easily in such a way that it is no more a burden to the IT organizations. The ability to link your expenses with the credit tool and import data into the expense management software tool would mean that the data has been prepopulated in the claim. This would again help you reduce the cost of all the claims with 78% per transaction. This would also mean that the data credited into this software tool is in one place and the report is all set to go on, giving you the insights of where you have been spending money and would help you negotiate the discounts with all your regular suppliers.

Keeping your enterprise in order: Being aware of all the new rules and regulations and managing all the related changes to related is considered to be time consuming and costly. And to a large co - operations when you have your business operating in different countries the challenges continue to grow and turn out to be complicated. Expense management software system to this would eliminate all the risks around the regulatory compliances, where they could easily apply for the complex tax rules providing in built auditing capabilities capturing the data required reporting the expenses spent for cooperation and income tax purposes.

Checking where your money goes: Having decisions made without a relevant data is not an easy job. Having travel and expense information that is centralized would make it simple and easy to report on a multitude of the performance indicators. This insight is important for the ongoing refinement of travel and the business expenses, identifying the areas of where the best deals could be negotiated with the suppliers. This would also help you identify the trends by the mode of transport, through clients, employee or the organization minimizing the fraud and regulation breach.

Minimizing the fraud: Accuracy is the most important key to an efficient system that would help you decreasing the fraud. The solutions here ensure that fair and consistent rules could be applied across the entire company, ensuring that the employees do not have the right opportunity to enter into the incorrect and out of policy claims.

Flexible and Scalable: The expense management software makes the entire process easy to manage, having a low risk and minimal implementation project costs that could be recovered quickly through cost savings and greater efficiencies. And we are all living in an economy where the companies could buy other companies, merge and expand their business into different territories and regions. This entire system is scalable to support the business growth where the solutions could be easily rolled out into countries and whenever required would support the external regulations, local currencies and VAT and per diem rates.

Author Bio:

Indira Moola, Marketing Operations Manager at Expenzing, focused on growing expenses management software India product and communicates the value of identity to customers, partners, and the larger community by targeting specific markets through segmentation and analysis.

What is Better – to Lease or to Buy Equipment?

Well,this is probably because Small businesses have difficulty raising capital - that's no secret. But Leasing equipment may be a better option for your business's equipment financing.

Equipment leasing is simply a process by which you obtain the use of a certain asset like a car, computer or software solution for which you don’t pay the full purchase price but instead you only pay a series of contractual, periodic payments while you use the equipment.

If you are worrying about how realistic your plans are (or if colleagues and friends have raised doubts), here is my take on the advantage of leasing computer equipment.

Technology will always change while on the other hand, not every jim and Jack has a budget readily available for these changes that is why a growing number of companies in this credit-tight economy are looking at leasing as a smart option that is accompanied by little risk.

Secondly, obtaining finance you need to purchase equipment is not easy, particularly where technology is concerned. Banks are more risk conscious than ever before, preferring safer investments of their funds such as real estate and more tangible assets.

For this reason many companies are finding it increasingly more difficult to obtain financing through overdrafts and loans.

I have often used this quotation on this blog and I will use it again, “Eneke the bird says that since men have learned to shoot without missing, he has learned to fly without perching” This Igbo proverb means People adapt to other people's learnings, particularly when the other person's learnings would harm you if you kept on your present course. In other words external factors can have effects on people so much that they change.

Leasing is the single largest form of external corporate finance in the world. In case you didn’t know, over 80% of companies – from small, start up to multinational companies at least lease one asset or the other.

I know that probably there may be very few leasing companies in your area but it is just a matter of time, remember what I said “people adapt to other peoples learnings”

ZRA Online Tax Filing-Reasons and Benefits

If you are still worrying about how realistic online tax filing is (or if colleagues and friends have raised fears about online tax filing) here is my take on it.

First, you only need to understand these step-by-step instructions on filing of your e-return using ZRA Online Tax to help you save time.

Secondly, bear in mind that you will need a computer with internet connectivity to successfully file return online. There are six steps to file e-returns. These Steps are:

1. Log into the portal

2. Download e-return form/s

3. Filling the details in the form/s

4. Validate the form/s

5. Uploading the form/s

6. Obtaining Acknowledgement Receipt

Thirdly, download this detailed Tax payer user guide for e-return filing to help you understand more about these steps for online tax filing. The guide has specifically been designed to give you a step-by-step guidance to online tax filling.

If you are still on the fence about joining the millions of taxpayers using ZRA Tax online facility to e-file their returns, here are some of the advantages.

File your return from anywhere.

Filling your tax returns online will not only save you time and money but will also give you the convenience of filling your taxes in the comfort of your home away from noise, the queues and traffic jam.Save money.

There are millions of tax payers in the country spending valuable hours in queues at ZRA offices every day, burning fuel in their cars and enduring the hassle of the traffic in town. You can save money if you choose to e-file your returns using Online Tax.There are many benefits and advantages of filing your tax returns online with ZRA Online tax. With these benefits in mind, you might want to consider switching to online tax filing.

5 Ways to keep your Epos System running smoothly

Basically the Epos system is concerned about support of the data entry procedure by means of different devices like keyboards, touch screen monitors and scanners. All of these are prone to faults and malfunctioning and if this occurs it can hurt your point of sale transactions for hours until fixed.

There are many ways to keep your Epos system working efficiently and without any fault. Some common ways of keeping the Epos system run smoothly are as follows:

UpdateEpos software regularly

Epos companies keep on working on fixing bugs and their new versions gets better stability and performances. Hence, make sure that you are updating your Epos software whenever a new version is available. Just set the notification on for any new version availability. Additionally, you can subscribe to the newsletter of your Epos vendor. Most of the Epos vendors communicate any new version availability or major release through their newsletters.

Have best supported accessories

Another way of ensuring the effective working of the Epos system is using the best supported accessories. If possible buy all the accessories from the same vendor from where you have bought your Epos system. Moreover, use multi-line bar code scanners. This ensures the pricing is kept accurate and honest working of system. Consequently the cashiers are allowed to work efficiently and quickly.

Have an updated antivirus

Computer systems are prone to get affected by viruses and malwares. Do not take a risk and always have an updated version of any good Antivirus installed in your system. There are some free antiviruses are available in the market, the best bet, buy a full version of any leading Antivirus software for a full protection.

Train your employees

Today’s Epos systems are so sophisticated that it doesn’t need proper training to use it. However, a complete picture of its functionality and a formal training to your employees can help you avoid some pitfalls that can arise due to mishandling. Generally all the Epos vendors provide free training to Epos users. Make use of that and schedule a training session and gather all your employees to attend the same.

Subscribe for support of your Epos provider

Generally Epos vendors provide free after sales support for a limited period of time and charge additionally for an extended period. It is always wise to subscribe for their support to ensure that you get immediate attention and remedy when your Epos system starts malfunctioning. It is better to be ready than losing business for hours in case of any failure.

Conclusion

In short,a well working and an updated Epos system is essential for keeping the sales system up to the mark. These precautions and activities help you to avoid a system failure that can hurt your business for hours. This will also be helpful in order to remove the manual flaws from the pricing system.

About the Author

Julie Evans is an EPOS expert and currently serves as the head of marketing at Epos Direct. For more than 16 years, she has researched and analysed the requirements of a wide range of business formats to develop EPOS software that satisfies their unique requirements.

The Changing Face of Asset Verification

The intention of this blog post is to provoke your thought regarding some of what I call the worst corporate accounting scandals in history as well as some of their more immediate consequences and the need of changing attitudes regarding fixed asset management practices.

These are more than just internet stories of white collar criminals. They are fraud schemes that resulted in loss of billions taken from corporate and investor coffers. Companies were forced into bankruptcy, costing hundreds of jobs, reputations were ruined and families were torn apart.

These are just a handful of events; some of the events we have just read about were in some manner due to failure of developing solid procedures for proper asset verification.

Like always, the global reaction to such has been the culmination of a continuous series of changes in asset management practices. The changes have encompassed strong regulatory frameworks and advancements in physical asset verification technologies.

Auditors have increasingly become intolerant to poor asset verification practices. It is no longer considered acceptable for a company to go for two years without getting its fixed assets verified at least once.

Additionally, physical verification of fixed assets has been made mandatory by corporate laws of many countries. In case of some countries it is now mandatory for the Auditors to report on maintenance of proper records, physical verification and substantial disposal of fixed assets.

No doubt, it is now becoming obvious that in future those responsible for the maintenance of proper records and physical asset verification will be more likely called to account when there is such a scandal, and it can be seen by recent trends, it is likely that it will not be companies but individuals like facility managers and financial controllers.

Does the process of asset identification, tagging and reconciling fixed assets every period stands out as an area of administrative burden and glaring inefficiency? Outsourcing has become one of the catch-cries by companies offering fixed asset verification solutions aimed at lowering direct costs.

Free Zica Accountancy Programme Download

Those with a lust for learning who happen to also enjoy testing the limits of what the accountancy profession in the region is offering in 2012 definitely don’t have to worry about finding new resources to guide them. The accounting profession is undergoing significant change and new opportunities are opening up for non-accounting professionals wishing to enter the field of accounting. Hundreds, if not thousands, of accountancy schools are out there just waiting for prospective students to request this free information.

In today’s article, I want to share a completely free resource, the ZICA Student-Handbook New 2012 Syllabus. A guide to all Zica Accountancy Programme for students.

There has never been a greater need for this new zica accountancy programme new syllabus in the accounting profession than now, Download a free copy of zica syllabus. It is completely free to download.

If you found this download useful please leave your comment. We value your contributions on this website.

Start your own business with a certified Computer Technician Course

This is a great time to start selling yourself on your own, especially if you're skilled in specialized jobs like that of a computer technician's. In fact, with the advent of social networking and online marketing, offering your skills as a computer technician may not require much start-up, marketing or buying costs at all!

Almost all small business and home owners rely on their computers to serve them well. It's harder for smaller establishments to afford large contracts with multi-service technician companies, so an independent provider like you would be just the answer they need. So what are some of the things you should know before starting your own computer technician training business?

1. Get certified. Most people won't trust a quack technician to come into their homes and touch their computers unless they've heard glowing recommendations about your service, or can see that you've been trained formally. For those with no training, computer technician training from an online vocational school can really help your sellability!

2. Keep up-to-date on the latest developments, especially in computer technology. Nothing is changing as rapidly in our times as the electronic realm of work. Doing an online computer technician certification in new and emerging technologies and methods every once in a while is a good idea.

3. Put yourself out there, but know your limitations. Don't bite more than you can chew. Your clients will appreciate that you stick by your word. Take time to experiment on new technologies and operating systems. Don't experiment on a live customer's computer if you can't help it.

4. Take time to understand your market, and be patient for results. You'll need to understand how your competitors work, and pitch your services at an advantage for your potential customers. Offer discounts, trials and satisfaction guarantees if you're confident about your service, but just be patient until you see loyalty and customer referrals doing the work for you.

5. Expect to put in long odd hours. This will especially be applicable if you are servicing home PC where owners may have time for you to visit their home only after their work hours.

6. Be professional. Dress well, and invest in your own business cards and company letterheads. It will add a sense of accountability to your profile.

Go ahead; take a chance on your own business if you're feeling lucky, adventurous or just plain tired of waiting for someone else to do the work for you. Being an entrepreneur has its own heady highs, and once you get a feel for it, we bet you won't look back!

Author Bio :

Nancy is a 36-year old stay at home mom of two. She worked as a medical assistant for five years before taking a break to be with her children. She loves to do the extensive research on the vocational training industry. She also writes about different ways to start-successful Business. Her other interests include gardening and baking. She stays with her husband and two daughters.

Greatest Benefit of Outsourcing Fixed Asset Services

We all want to spend less time on inventory accounting tasks but we don’t want to take the plunge into the world of savings. After all a task you undertake with internal staff feels like a natural resource. But when it comes to data collection it’s all about time, and time is money.

Despite fixed asset tagging and reconciliation services becoming increasingly mainstream and acceptable in Africa, for many organizations it is still tempting to tackle asset inventory by themselves.

Of course, that’s not to say that the only companies that are embracing fixed asset accounting services are international companies. There are some fantastic success stories of local banks and utility companies in the region that have successfully carried out physical asset verification projects. Their success is down to the fact that they took steps to free themselves from the limitation of working with internal resources alone.

Most companies conduct a physical inventory once a year. It really doesn’t have to be said but I will say it anyway. Physical asset inventory is an expensive process that very few employees enjoy.

If you gave employees a choice between participating in the company’s annual physical inventory and going for a corporate cocktail party. Which one would they choose?

The thought of spending the better part of a weekend out of office in unbearable hot and dusty warehouse or traveling to remote sites, trying to count every piece of asset, finding materials that you can’t really identify, and searching for “ghost” assets is not what most employees would like to do.

If you ask any one who has ever taken part in a physical inventory count he’ll probably say, because the Finance Manager or the accountant required the figures.” They don’t see any advantage in doing a good job or being accurate. Most feel that the accountant is only going to use the numbers we give him on some reports that no one is going to look at.

Yes, management knows the fact. They know that large inaccuracies in fixed asset reporting may cause flaws in the overall accuracy of corporate financials, posing a threat to the management team as they are responsible for ensuring regulatory compliance and they also know clearly that sound fixed asset management can yield substantial savings in company tax and insurance premiums. But if the people counting don’t realize the importance of accurate inventory balances, the chances for obtaining errorless counts far fetched.

This is where physical inventory service outsourcing fits in. Asset tagging and reconciliation services offer a structured organization to a company's fixed assets, which provides an accurate record for the following accounting and administrative purposes

• Financial reporting

• Capital expenditure planning

• Insurance requirements

• Accountability and control

• Compliance with Audit requirements

• Accurate perpetuation of the system

I guess you are now thinking about physical inventory outsourcing option seriously? Why not? Here are some good reasons to consider outsourcing your next physical inventory.

If you don't have the dedicated staff available to get the job done accurately and you are required to take periodic physical inventories of your fixed assets, then consider outsourcing.

However, even if you do have the resources...outsourcing fixed asset accounting services allows you to let your employees focus on their existing responsibilities. At least one person will need to take the time to learn how you use your new fixed asset tracking system; however, everyone else is spared from the tedious physical inventory process. Most importantly you will work with a team that understands your accounting needs.

In most cases good physical inventory service providers make extensive investments in technology, methodologies, and people. They barcode inventories and reconcile all your fixed assets, provide fixed asset tracking software, supply asset labels and barcode scanners. When they are done, you'll have a customized system in place that will make all your future physical inventory of fixed assets simple and more accurate.

Why not leverage the expertise and knowledge of the professionals in companies that specialize in asset management solutions?

How Professional Tax Software Can Benefit Even The Smallest Business

Taxes can be a challenging requirement of everyday life. While taxes pay for roads, schools and other infrastructure, it can be challenging to pay a significant amount of one’s business income towards taxes.

In addition, it can be challenging to understand how tax regulations evolve over time. Since the government amends the tax code on an annual basis, it can be difficult to understand how new deductions and taxes loopholes can impact a business’s bottom line.

It’s also important to understand the expenses associated with a professional accountant. While an accountant can be a good choice for a larger business, it may not be practical for all smaller businesses and organizations. In many cases, a professional certified public accountant (CPA) can cost thousands of dollars a month in payroll. This may not be a cost that all businesses can afford.

In many cases, smaller businesses will hire budget accountants to manage their finances. While a part-time accountant is a lot cheaper than other options, they do have several significant disadvantages. In many cases, a part-time accountant doesn’t have the same training or experience as a full-time accountant. In addition, he or she may not know enough information about a business to make intelligent decisions. This may cause a business to pay higher tax rates than is necessary.

Deductions can also be a tricky issue for many businesses and organizations. The 2011 tax code contains over 832,083 words. This is longer than almost all books. Since one person can’t read this much information or his or her own, it may not be possible for a single individual to have a comprehensive understanding of the global tax code.

In addition, deductions have to be approved every year by the government. Since deductions usually expire after a certain amount of time, deductions that were valid one year may not be valid the next year. This can make it tricky to understand how deductions change and can make it difficult for businesses to maximize their potential deductions.

With professional tax software, it’s possible to quickly and easily manage the financial needs of a company. Since professional tax software is updated on an annual basis, there is no need to worry about missing deduction or unpaid taxes.

In addition, professional tax software comes with built-in auditing tools. Since it can be challenging to audit financial information on one’s own, it’s important to have tools that can do this automatically. By auditing tax information before it’s submitted, it’s possible to reduce the risk of an IRS audit in the future.

It’s also important to understand how professional tax software can help a business save money. In addition to reducing the risk of an audit, professional tax software can help a business save money on payroll. By avoiding additional payroll costs associated with an accountant, it’s possible for businesses and organizations of all sizes to save money.

About the Author: Tim Thomas has had 10 years of experience in tax accounting with TaxWorks. He could tell you that the industry has evolved and there are now things to help with efficiency, such as small business tax software. No matter how you prepare your personal taxes, as a business it is a good idea to have the best possible tax software in order to be as efficient and accurate as possible.

How to Transition Your Business to the "Cloud"

What is the Cloud?

The Cloud is a term for the part of technology that insures that information we send over the web is correctly routed to the proper destination. The cloud of today was created over time due to a need for storage, databases and software. Before the cloud, information was saved to floppy disks and then taken to its recipient. However, that was not economical for businesses so servers were created. These server networks were able to share information easily throughout offices but presented a problem if information was needed to be shared with sister offices that were not on the same office server. To solve this problem, wide area networks were created. These networks run through lines (now internet lines) provided by cable and phone services. When information would be sent out through these wide area networks, many people didn’t understand where the information went, appearing as though information was sent into the sky and somehow ended up in the right spot. It was this thought process that developed the name “the Cloud.” So the beginnings of the Cloud essentially insured information sent ended up in the intended destination.

As time progressed, businesses housed servers and databases that assisted the cloud in sharing information. The idea to have databases and servers that connect directly to the cloud soon were developed, thus creating economical computer solutions for business owners.

Companies were created to house databases and servers that allowed direct storage within the cloud. This eliminates the need for individual businesses to have servers and databases within the offices. Soon other companies were created that had software on their servers and provided a service of software on the Cloud. Service as a Software (SAAS) allows companies to access software on the cloud instead of installing software on every computer within the business. This also eliminates the need for updating every single computer within the company, as the SAAS company updates the software without hassle to business owners. One software application the many businesses are familiar with is accounting programs such as QuickBooks. By using the QuickBooks program on the Cloud, it allows businesses QuickBooks remote access to finances at anytime and anywhere there is an internet connection. It also eliminates the need for constant, time consuming updates.

Transitioning your Business

Now that you have a better understanding of what the cloud is and how it can assist businesses, let’s talk transitioning.

Depending on your business, transitioning to the cloud can be an exciting innovation or met with distain. If you are a company that embraces in technology, transitioning to the cloud will be easy and fun. If you are a company that has used the same programs for years, you may be met with some opposition from employees. The best way to transition employees to a new system is to host educational conferences with information and training on the new way to share data and access software within the company. Many may doubt crossing over to the cloud but it easily places all business needs in a simple, one stop format. The cloud offers amazing opportunities for applications and the use of those applications from anywhere. Whether from a phone, desktop, laptop or tablet, your employees will be able to access all they’d need to sustain your companies work model. Once employees are aware of how much simpler work tasks will be by using the cloud, they often times embrace the cloud and never look back.

Another part of business transition to the cloud is excess servers and hardware. Once you’ve moved to the cloud, offices now have no need for the computer servers and hardware they once used. While transitioning, look into recycling or donation programs for your unused hardware and servers.

Lastly, hire a professional (often times the company providing your cloud services has someone) to help cross over and integrate your business’s existing systems to the cloud. This will save time and hassle and start you on your way to Cloud business practices.

The Result of a Transition to the Cloud

Businesses that transition to the Cloud experience increased efficiency in sharing information and using software systems. A perfect example is the remote access QuickBooks provides over the cloud. It results in access from any computer within the company to assist in accounting effectiveness. Businesses that transition also experience lower operating costs and ease of information sharing between employees and customers.

Levion is an integration for QuickBooks for Windows that allows remote access to QuickBooks. Levion allows the user access from any device with an internet browser. Levion joins your existing QuickBooks functionality with the mobility and availability that QuickBooks remote access login allows. Levion is not a QuickBooks app—it is QuickBooks re-imagined.

Author Bio: James has provided guidance for many years to entrepreneurs and has become very educated with Quickbooks remote access. Levion is a particular company that allows the users access from any device with an internet browser. Levion helps you work alongside your existing QuickBooks.

Write for Us

Accounting Diary welcomes unsolicited articles and blog posts. If you are interested in writing for us, please fill out the form below.

The Right & Wrong of “Chilimba Investment Schemes”

All of us need Money from time to time. After all, Money is much a part our life. We need to raise Money to Finance our education, finance our business plans and meet daily needs.

But when it comes to investing money, there is the right and wrong way to invest. Am not here to tell you where to invest your money, but show you the right and wrong way of investing your money.

The report suggests that “although the Chilimba is useful, however it does not constitute a real social security scheme. Nevertheless it has the potential for being strengthened as long as it remains informal or semi-informal.” The report further warns that, “the formalisation of the Chilimba scheme into, for example a non governmental organisation presents a possible danger of creating cleavages, ultimately leading to its collapse.”

What Accountancy Students Must Know