The range of services that accounting firms provide to their clients is both broad and diverse. As a matter of fact, there is a good choice of Accounting firms in Zambia including affiliates of the global accountancy groups like KPMG, PwC, Ernest and Young and Deloitte.

The following directory provides a list of Zica registered audit firms to will help you find accountancy, audit and tax experts easily.

It is a complete list of audit firms, professional accounting firms that are fully registered by Zica both non audit practice firms and audit practice firms

Souce: Zica Website

Zica Registered Audit Firms

Why Cemeteries in Africa Need CIMS Software

Human death and burials are part of human life. Among many cultures in Africa, cemeteries are more than just a place of burial they carry spiritual, religious and cultural significance.

The reality is that the thousands deaths through AIDS have created a serious problem in regard to the existence and future of cemeteries in Africa and the burden of day-to-day management, long term planning and sustainability remains with local authorities.

As city centers emerge, management, maintenance, record keeping and environmental issues related to cemetery management become key issues of concern in many African countries.

With the shortage of burial space in Africa’s big cities, some local authorities in countries like Zambia, South Africa and many African counties slowly plan to professionalise the burial industry. Stories of adopting new practices and good practices like burying more than one family member in one grave are currently under consideration in many Africa countries.

However, the true challenge of cemetery management in Africa begins with cemetery mapping and information systems. Most council cemeteries were opened way before GIS cemetery digital mapping existed. Since then a few cemeteries relied on hand-drawn inaccurate cemetery plot map while in most cemeteries no cemetery database existed.

To accomplish this goal of best practices in cemetery management, a different approach to traditional cemetery records management is required – one which encompasses in new, yet simple technology that can enhance customer experience by providing families with more interactive and helpful tools to memorialize a loved one, and use the web technology to interact meaningfully with cemeteries and preserve the burial records from fires, floods and many other natural disasters. Record protection is vital to preserving the history of the cemetery whilst also ensuring the cemetery is operating efficiently. Happily, the scenario is slowly changing. There are a few success stories of cemeteries in Africa using some simple innovative cemetery software to help visitors locate grave sites.

Please take a moment to answer these questions….

- Are your grave, burial, cremation registers, books of remembrance, and plot maps deteriorating from being used everyday? Are they getting difficult to read?

- .Do members of your staff have difficulty handling the large registers?

- When members of the public ask for historic information, do you still manually search through the books in order to find records?

- Are you interested in putting your records online for the public to view

- Are you looking for a robust, low-cost and simple to use Cemetery Information Management System (CIMS) for your Cemetery or Crematorium?

How to use eNapsa to file Monthly Napsa Returns

Do you need to submit your NAPSA return? Submitting your monthly NAPSA returns online via eNAPSA is easy and convenient once you understand the steps.

The National Pensions Scheme Authority has implemented eNAPSA a new system for filling monthly NAPSA returns before making payment.

To start using eNAPSA you can follow this step by step guide below.

Step 1:

Complete the eNAPSA services registration form which can be downloaded from the NAPSA website under the menu “Pension Information > Contributions > Contributions downloads” as shown below or alternatively you can obtain a hard copy from any NAPSA office.

Step 2:

Return the completed form to a nearest NAPSA office or you can scan and email a completed form to to Customer Services via info@napsa.co.zm and wait for the SMS from NAPSA which will confirm your account update.

Step 3:

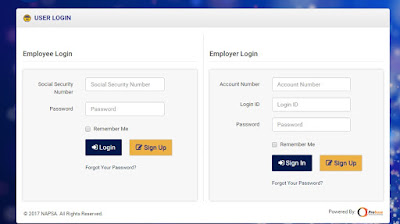

Finish the eNAPSA registration process by visiting the NAPSA website www.napsa.co.zm and click on eServices tab and go to sign-up.

Step 4:

If you are an employer, login using the employer account number, login ID and password but if you are a member, use your social security number and password sent to you by the eNAPSA system via sms.

If you face any particular challenge with signing up and uploading returns, do not panic, the Authority has set up eNAPSA help desks at all their offices countrywide.

Their eNAPSA helpdesks are open on all working days across the country feel free to call their toll free number 677.

7 Ways On How An Accountant Can Help Businesses Today

|

| Zica Graduates |

Understanding a Tax Invoice

I am compelled to write on what I term the gross misuse of source accounting documents by some small and medium Enterprises (SMEs).

It pains me to go in a business entity, make a cash purchase and the accounting source document you are given as proof of the purchase, is a document called tax invoice with a paid stamp on it.

This trend is common among businesses especially in the supply business. Sometimes I wonder if these businesses do engage well trained accountants who should be able to advise management the proper usage of accounting source documents such as a tax invoice.

Honestly speaking how can a tax invoice bear two names at the same time? On the far corner it is written a tax invoice while at the other end it bears a receipt name.

Although the Zambia Revenue Authority (ZRA) administration of value added tax (VAT) entails that its determination is based on the tax invoices especially to the supplying businesses, it has not changed the meaning of the definition of an invoice.

I say so because these problems of misuse of source documents are emanating from the misunderstanding of the use of the tax invoice as demanded by ZRA.

Let the entrepreneurs know that the description of an invoice remains the same whether it is disguised as a tax invoice by ZRA or not.

An invoice is a source accounting document that is issued by the supplier to a customer who obtains goods or services on credit and promises to settle a payment at a later date.

Therefore it is not in order for a supplier to issue an invoice to a customer who makes a prompt cash payment.

However in this article I want to trace why some suppliers are issuing tax invoices in place of a receipt because a source document which is issued for prompt payments, is a receipt.

This is so because VAT is driven by invoices and its calculation is based on the issuance and retention of tax invoices when calculating it.

Therefore the law requires the retention of tax invoices and other tax records for the period of not less than six years from the time they are issued.

The tax invoice is an invoice which is designed by the tax office to suite its requirement for the benefit of collecting VAT by the Government and is enforced through the law.

The rate of collecting VAT in Zambia is 16 percent. Registered suppliers for VAT purposes are required by law to issue tax invoices to their customers, but this mostly applies to non-retail suppliers in this country.

A tax invoice has certain requirements on its face required by the tax office. The following are the tax invoice requirements demanded by the tax office on the face of a tax invoice:

1. The word tax invoice must be on the face.However even the issuance of tax invoices by the businesses who are non-retailers is backed by the VAT law, the tax office has not replaced the receipt with the tax invoice.

2. The name and address must be on the face

3. The VAT registration number has been replaced by the tax payers identification number (TPIN) on the face.

4. The serial number of the invoice and the date of issue, a must.

5. The quantity or volume of goods or services supplied.

6. Description of the goods or services supplied.

7. The selling price excluding the VAT and any discount allowed.

8. The total amount of VAT charged.

9. The total amount of VAT inclusive.

Instead, as a matter of prudent accounting and practiced by accountants who know the implication of the invoice and a receipt in the books of accounts, will issue a tax invoice immediately followed by the receipt for the purpose of fulfilling of the VAT law.

The advice given to businesses that are issuing tax invoices to the customers who make prompt cash purchase to customers in order to fulfill the VAT law is that immediately they issue a tax invoice should issue cash purchase receipts to cancel the invoice.

9 Major Tips to Manage the Business Expenses of Your Organization through Spreadsheets

Expense Management Software – Top 10 Reasons Why Companies Need To Implement Them

Still claiming your expenses via spreadsheets, outdated legacy or in house system. Is it time to look back on the traditional ways with nostalgia, as here are the top 10 reasons why expense management needs to be automated in the right way and you don’t have to be a big organization as the benefits are hard to ignore.

Saving your money in more than 1 way: Many business organizations fear of being trapped and continuing with their current system, as the organizations these days are more worried about the cost to change. The implementation of these pricing models are based on the usage could be done quickly and easily in such a way that it is no more a burden to the IT organizations. The ability to link your expenses with the credit tool and import data into the expense management software tool would mean that the data has been prepopulated in the claim. This would again help you reduce the cost of all the claims with 78% per transaction. This would also mean that the data credited into this software tool is in one place and the report is all set to go on, giving you the insights of where you have been spending money and would help you negotiate the discounts with all your regular suppliers.

Keeping your enterprise in order: Being aware of all the new rules and regulations and managing all the related changes to related is considered to be time consuming and costly. And to a large co - operations when you have your business operating in different countries the challenges continue to grow and turn out to be complicated. Expense management software system to this would eliminate all the risks around the regulatory compliances, where they could easily apply for the complex tax rules providing in built auditing capabilities capturing the data required reporting the expenses spent for cooperation and income tax purposes.

Checking where your money goes: Having decisions made without a relevant data is not an easy job. Having travel and expense information that is centralized would make it simple and easy to report on a multitude of the performance indicators. This insight is important for the ongoing refinement of travel and the business expenses, identifying the areas of where the best deals could be negotiated with the suppliers. This would also help you identify the trends by the mode of transport, through clients, employee or the organization minimizing the fraud and regulation breach.

Minimizing the fraud: Accuracy is the most important key to an efficient system that would help you decreasing the fraud. The solutions here ensure that fair and consistent rules could be applied across the entire company, ensuring that the employees do not have the right opportunity to enter into the incorrect and out of policy claims.

Flexible and Scalable: The expense management software makes the entire process easy to manage, having a low risk and minimal implementation project costs that could be recovered quickly through cost savings and greater efficiencies. And we are all living in an economy where the companies could buy other companies, merge and expand their business into different territories and regions. This entire system is scalable to support the business growth where the solutions could be easily rolled out into countries and whenever required would support the external regulations, local currencies and VAT and per diem rates.

Author Bio:

Indira Moola, Marketing Operations Manager at Expenzing, focused on growing expenses management software India product and communicates the value of identity to customers, partners, and the larger community by targeting specific markets through segmentation and analysis.